Thinking about how digital financial services are used to manage money? Don’t worry because you aren’t the only one here! Increasing dependency on the online world is a vital topic and we all need to find what applications to use to manage our online lives.

So that you can master your finances today, we will look at the latest digital financial tools and apps. From budgeting apps to crypto, there is something for all in this world.

What is digital financial tools and applications?

Digital finance solutions, quick and precise alternative to the growing complexity of financial management. Through digitalization, banking, finance, and investments are easier to manage. These can be fit into the budget efficiently and help to interpret data accurately.

Digital apps can carry out related operations for financial processes such as transfers, day trading, and accounting. E-banking solutions are the personification of this. The objective of this is to make money management convenient for customers via automated bill payment and direct deposits.

Financial institutions or advisors turn to digital applications so that their customers can receive services from mobile devices as well as from the Internet. The “One-click” method is accessible to clients who need to apply for credit cards or loan products. These services include balance checks, international money transfers, online bill payments, and alerts.

The automated payment systems make the transaction process faster lowering the labor costs and enabling consumers to access services at any time they want from any place.

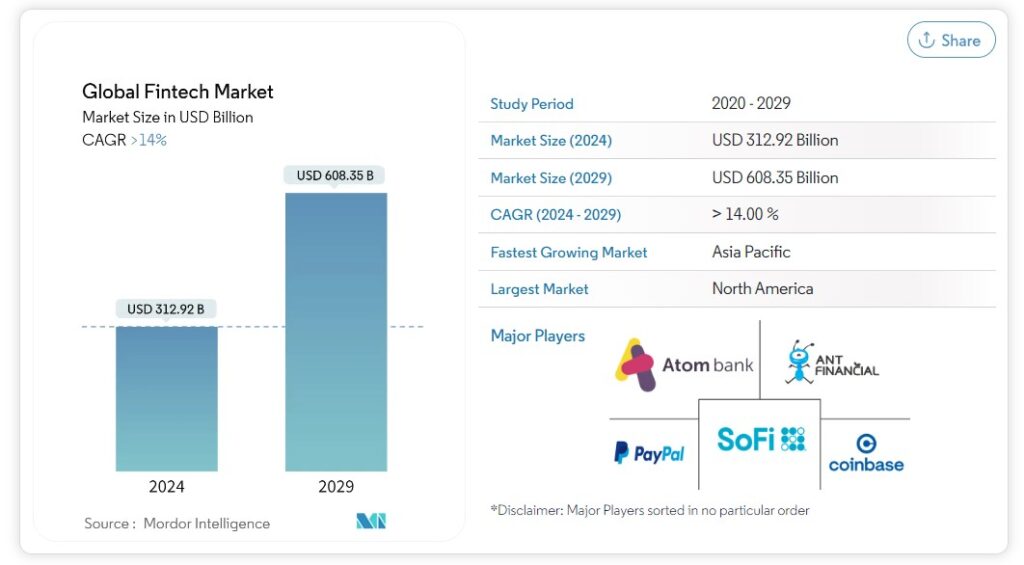

According to a report till “April 30, 2025: The global financial technology sector is one of the fastest-growing industries in the world. for the first time, It exceeded the $100 billion mark in investment. This shows how technology is important in reshaping the future of financial management.

Also Read:- SaaS Analytics To Improve Business Economics

Digital applications can help businesses to do capital management, therefore it is possible to optimize expenditures as well as profits. Digital solutions are able to achieve quicker transactions with lower error rates than manual processing while ensuring the quality of the outcome. Speed and accuracy are two things that are important in ensuring that a business runs smoothly.

Brief history of the development of digital financial tools

The digital finance has changed the approach of individuals to money control. Modern tools provide personalized experience via data and analytics.

Interactive services started to be offered by financial institutions in the mid-2000s. They provided simple online banking functions and online bill payment.

The mobile technology in the 2010s brought finance apps nearer to consumers. Security features such as Touch ID and Face Recognition were also introduced. The budgeting tools have been enhanced with the application of AI.

Nowadays, traditional ways clash with technology at its peak. Digital finance offers convenience, security and personalized counseling. The wonders that digital finance can do are endless, irrelevant of size or location!

Also Read:- 11 Best Technical Support Outsourcing Companies In 2024

Here are some tips for leveraging digital financial tools to enhance money management

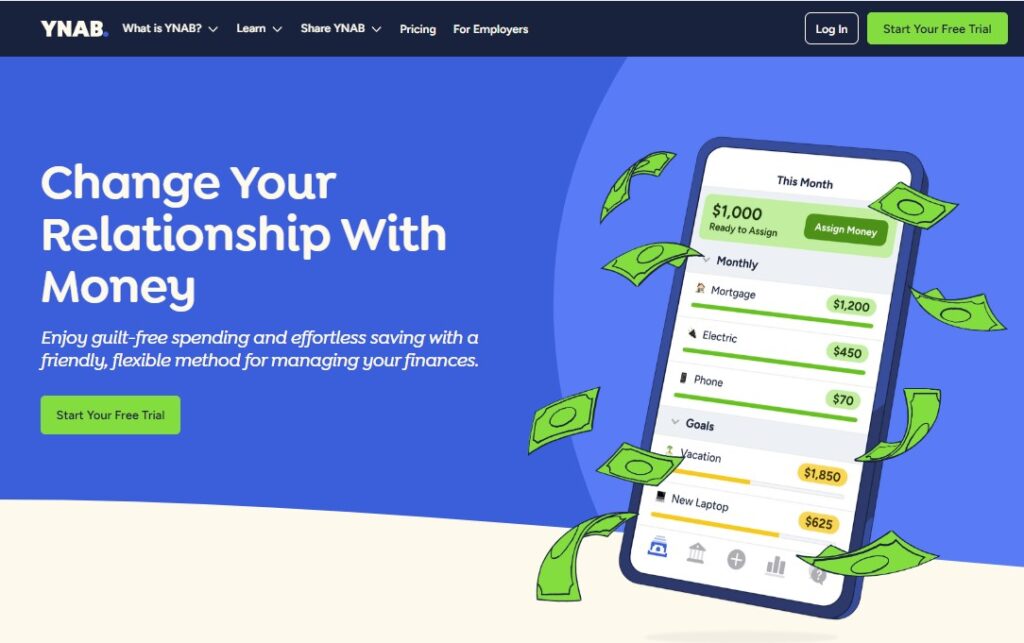

- Download apps like Mint, YNAB (You Need A Budget), EveryDollar, etc to keep all your accounts connected and sorted out to show where the money goes to. They work as budgeting systems for preparing the expenditure.

- Automate your recurring bill payments through your bank account or choose to have the billers send you a direct debit instruction. This action then guarantees you won’t be late with payments and also that the amount you pay is right. Many of them disturb (as in notify) us when the bills have been processed, and they also alert if there are any issues concerning payment.

- Set up a standing order to transfer money to savings through the bulk of bank. If you’re not able to make a big lump sum deposit to your savings account, nevertheless small and consistent transfers can accumulate the amount for unexpected expenses or long term purposes in the future. This is hence a passive transit of money to the saving account.

- Banking and credit card alerts are also useful for monitoring daily expenses. Most financial institutions and cards providers do provide you with the security alerts and the spending threshold alerts would allow you to receive notifications of large transactions or suspicious activities. This actually helps you to refresh your mind and you can see exactly how much you have been spending in real time.

- Save effortlessly via your retirement account or by the means of investment apps. Automatic recurring transfers into investment plans like 401k or IRA as well as robo-advisory apps make investing a possible reality even for busy people since these apps do all that is needed for them.

- Utilize personal finance apps to utilize the net worth calculator. Apps can collectively unify accounts related to investment, retirement, banking, loan and credit cards in order to present a broader picture of debts and assets over a period of time. Monitoring can uncover issues.

- Work automation, effectively alerting, and visibility tools are the suitable answer to the hands-on work of money management. This way money managers can eliminate late fees, spend less and be surprised by the financial status by letting the autopilot feature run through the saving and investment.

What are the types of digital financial services?

Some of the main types of digital financial services include:

- Payments:- Platforms known as digital wallets, payment apps, and online banks that allow people and the business to send, receive, and fund digitally. Citing the examples given, we can include PayPal, Venmo, Zelle and Apple Pay.

- Lending:- Online loan services that provide loan and financing choices via digital/ virtual platforms. This also entails the provision of online lending facilities such as Upstart, LendingClub as well as Prosper.

- Digital opportunities:- Online investment platforms and robo-advisors that offer tools to manage your money and give investment advice. For illustration’s sake, these companies include Betterment, Wealthfront, and Robinhood.

- Banking:- Banks which provide checking/savings accounts bank mainly through digital channels, offering completely or limitedly physical branch experience. The instances are represented by Chime, Ally Bank, and Varo.

- Digital insurance:- Platforms of insurtech, which process of insurance, management and claims are handled in digital way. As examples of them we might mention Lemonade, Root, Metromile.

- Cryptocurrency/blockchain services:- Such services permit users conduct the buying and selling of digital assets, manage digital wallet as well as various online exchanges. It is apparent that Coinbase belongs to this group of platforms.

Therefore, digital finance is about providing financial services in a better, faster and cheaper way through technology and the internet. It is about using technology to provide products such as payments, borrowing and investing more efficiently for consumers.

Financial sector digitization can be seen as the main tool main service provider in making them accessible. Thanks to the synergy between finance and marketing, it’s possible to achieve maximum results by increasing consumer engagement and strengthening trust in digital financial solutions.

What is the uses of digital Tools in finance sector?

Here are some of the main uses of digital tools and technologies in the finance sector:

- Data Analytics:-In their day-to-day operations, financial organizations use data analytics tools that include business intelligence, data visualization, and big data platforms among others to gain insights from data as they work to inform better decision making. This kind of software is developed to carry out work like financial prognosis, fraud examination, risk assessment, etc.

- Fast and efficient trading:- Digital trading platforms and algorithms are used to process orders as fast as possible and since they can perform millions of calculations per second they are faster, more efficient and less prone to human errors than the traditional trading. They facilitate high-volume, algorithmic and volume trade in this market.

- Electronic Payment:- Digital processing of electronic payment systems, creates more opportune, convenient and fast fund remittances both within countries and globally. Just as phones equipped with mobile wallets allow consumers to pay for goods without their cards or cash being involved, the blockchain technology now enables simplified, safe, and more accessible banking.

- Security:- Digital security, encryption, biometrics etc., serve as a shield for the secure transfer of financial information on digital platforms and databases. The cyber medical field includes the application of technologies such as blockchain and AI that are boosters of cybersecurity concurrently.

- Lending and Financing:- Alternative digital lending platforms can make use of decisions on lending and offering financing through data analysis and use of algorithms to identify risk and make an informed decision. This creates a channel for borrowing capital.

- Instant agencies:- Banks and financial organizations offer an online portal with a mobile app, customers can access the financial information, conduct transactions etc. in a self-service 24/7 mode.

In essence, the purpose of digital transformation in finance to be is offer customer services fast, easily and safely and also to enhance of institutions’ efficiency and reduction of costs. The way these emerge as potential enablers is through the analytic, automation and innovative technologies.

Advantages of using digital financial tools and applications

Here are some of the main advantages of using digital financial tools and applications:

- Convenience:- Financial applications on digital devices give you an opportunity to manage your finances at any time of your day whether you are using your mobile phones or computers. These tasks include checking balances and transactions, making and receiving payment and transfers, depositing checks, handling bill payments, and more.

- Easy reach:- The benefit of the majority of the digital financial tools is that gives you a view of all that you have and where all your finances are located in one place. That means you’ll get a helicopter view as well as be able to follow the progress of your wealth gradually.

- Budgeting features:- Each app comes with budgeting features. These features allow you to link your banking accounts and see your spending patterns. That makes it very easy to categorize your spending and set up budgets. In the same time, you can control your process through tracking.

- Alerts and notifications:- With this feature, you can receive customized alerts and notifications about different financial matters. Such as withdrawals and deposits over a certain amount, approaching account minimums, bills before their due date, etc. As you are up-to-date on your finances, it is almost certain that this will prevent overspending and other financial errors.

- Peer-to-peer transactions:- A variety of applications, such as Venmo, PayPal, and Zelle, empower you to flexibly split payments with friends and family and send payments to other people directly. This method provides a faster and a cleaner payment option than cash and checks.

- Security:- Digital financial instruments use encryption, passwords and other security measures thus helping to keep your money and information safe from unauthorized access or theft. Established sources will settle the application as well as give you fraud monitoring and protection.

- Saving and investing options:- Most apps automate your record of savings and make you investment safer by putting the money in high yield savings or checking accounts. These ones too facilitate buying and selling of stocks, bonds and funds.

- Financial management:- Digital apps that provide an interface for money management where you can take a bird’s-eye view, add budget, and receive notifications about your finances can greatly help you spend wisely, make better decisions about money, and get organized with your finances. Employment leads to improved financial results.

Importance of digital financial tools for managing personal finance and investments

Online financial instruments as well as banking instruments have become a pillar of personal finance and investment environments in the 21st century. There is a variety of financial technology, for example, online banking and budgeting apps, investment platforms and cryptocurrency that are changing how the world is handling money.

The addition of digital financial tools into the market has simplified and improved the performance in a way that online transactions were not achievable. They have, for instance, budgeting apps that directly and automatically tie to one’s bank account to list down their spending and provide analysis on spending habits. This in turn leads to the rise of conscious spending as they learn to distinguish what really matters from unnecessary expenses.

Online investment platforms allow the public to enter the stock market and thus participate in the DIY investment program and earning of wealth. In general, digital financial instruments assist individuals in having better financial management, finding the best outlets, having machines come in handy in doing some manual tasks, having adequate insights about how their finances go and having control over their financial futures.

The platforms do more than just advise: they suggest and personalize the approaches so as to create financial health. Whether it is to settle the debt within the set time frame, save up with the major goal on the mind or build lasting wealth as your goal, digital financial technologies are at the base of the choices you make when it comes to your money.

Conclusion

The popularity of digital financial tools and applications is increasing, and their role in our lives should be comprehended. We should be thoughtful when picking them, and keep in mind: customer reviews, what ones suit our requirements, security features and industry standards.

Advantages of these tools include: speed, tracking of income and expenditure, central storage of data, automatic reports and access to international markets.

Properly used they provide us with management of our money and comfort. This quick reference hardly scratched the surface of the capabilities of these apps. We will continue to learn about their possibilities as new discoveries are made.

Frequently Asked Questions

Q1: What digital financial tools and applications are available?

A1: There are many digital financial tools and applications such as budgeting apps, investment tracking apps, peer-to-peer payment apps and the like.

Q2: What is the best digital financial tool or application?

A2: The suitable digital financial instrument or application differs from one person to another. One needs to surf through different alternatives and compare them in order to find the best one.

Q3: How can I use digital financial tools and applications?

A3: Using digital financial tools and apps, you can manage your finance, track investments, perform payments and so forth. You can use these apps to save money, reach financial goals, and keep your money in order.